Resources

Tax Due Dates

• Jan. 15, 2025: Due 4th quarter estimated tax payment for tax year 2024

• Jan. 31, 2025: Deadline for employers to mail out W-2 Forms to their employees and for businesses to mail 1099 Forms reporting non-employee compensation(1099-MISC), bank interest(1099-INT), dividends(1099-DIV), and distributions from a retirement plan(1099-R)

• Jan. 31, 2025: Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, derivatives or other securities through a brokerage account, Form 1099-S relating to real estate transactions; and Form 1099-MISC, if the sender is reporting payments in either boxes 8 or 14

• March 15, 2025: Deadline to file/mail S-Corporation tax returns (Form1120-S) and partnership tax returns (Form 1065) for tax year 2024, or to request an automatic six-month extension (Form 7004), and for payment of any tax due though filing extension

• April 15, 2025: Deadline to request an automatic extension (Form 4868) for an extra six months to file your return, and for payment of any tax due even though filing extension

• April 15, 2025: Deadline for household employers who paid $2,200 or more in wages in 2024 to file Schedule H for Form 1040

• April 15, 2025: Due 1st quarter estimated tax payments for the 2025 tax year

• April 15, 2025: Deadline to file/mail individual tax returns (Form 1040) for the tax year 2024

• April 15, 2025: Deadline to file/mail C-Corporation tax returns (Form 1120) for the tax year 2024

• April 15, 2025: Deadline to make IRA and HSA contributions for 2024 tax year

• June 16, 2025: Due 2nd quarter estimated tax payments for the 2025 tax year

• June 16, 2025: Deadline for U.S. citizens who living abroad to file individual tax returns or file for an automatic four-month extension (Form 4868)

• Sept. 15, 2025: Due 3rd quarter estimated tax payments for the 2025 tax year

• Sept. 15, 2025: Deadline to file S-Corporation/partnership tax returns (Forms 1120-S and1065) for tax year 2024, who requested an extension

• Oct. 15, 2025: Deadline to file C-Corporation tax return for the year 2024 (Form 1120), who requested an extension

• Oct. 15, 2025: Deadline to file individual tax returns for the year 2024 (Form 1040), who requested an extension

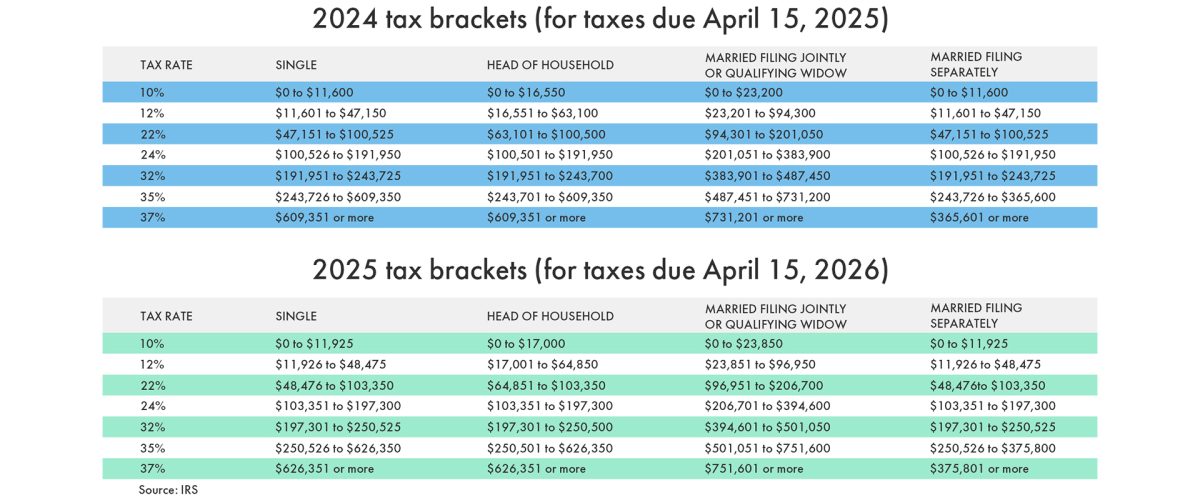

Tax Rates